AIA Flex PA Plus

🛡️ AIA Flex PA Plus

Personalized Protection for You and Your Loved Ones

Flex PA Plus is a personalized personal accident insurance plan designed to prepare you for the unexpected. It helps you cope with financial challenges arising from life-changing incidents by providing optimal coverage across medical, essential, and lifestyle support.

🌟 Key Product Highlights

-

💰 High Coverage Limits: Get protected with a sum assured of up to RM3,000,000 to ensure your coverage is adequate.

-

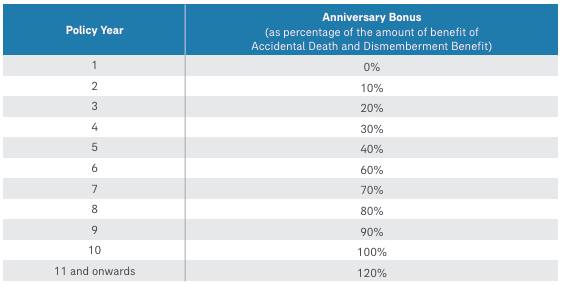

📈 Anniversary Bonus: Enjoy an increasing benefit of 10% per year, up to a maximum of 120% of your original sum assured, if you continue to renew your policy.

-

🦠 Infectious Disease Coverage: Stay protected against 25 Infectious Diseases (such as Dengue, HFMD, and Zika) and Food Poisoning .

-

🚗 Double Indemnity: Receive additional benefits for accidental death occurring in public conveyance, road traffic accidents, or natural disasters.

-

🌪️ Natural Event Protection: Coverage includes accidents caused by lightning strikes or fallen trees .

📋 Core Benefits at a Glance

-

💀 Accidental Death & Dismemberment: Provides a lump-sum payout in the event of death or permanent disability due to an accident.

-

🏥 Medical Treatment Benefit: Reimburses necessary medical and surgical expenses, including physiotherapy .

-

💳 Cashless Hospital Admission: Enjoy hassle-free admission at any panel hospital in Malaysia.

-

🏨 Daily Hospital & ICU Allowance: Receive a daily cash allowance for up to 365 days if you are hospitalized due to an accident .

-

🧠 Serious Condition Payout: A one-time payout for conditions such as Coma, Major Head Trauma, or Third Degree Burns .

-

🧘 Post-Accident Recovery: Reimburses expenses for Occupational Therapy, Speech Therapy, and Post-Trauma Counselling .

✨ 5 Optional Riders to Maximize Your Cover

Customize your plan with these five riders to address specific life needs:

1. 🦷 Medi Plus Rider (Enhanced Medical Recovery)

This rider is designed to cover the "extras" that standard medical plans often miss:

-

💰Extended Limits: Reimburses medical expenses that exceed the limit of your basic plan.

-

🌿Alternative Medicine: Covers treatments by registered acupuncturists, bonesetters, chiropractors, or osteopaths following an accidental injury.

-

🩹Restorative Surgery: Reimburses costs for corrective dental and cosmetic surgery performed on the neck, head, or chest due to an injury.

-

🦽Mobility Assistance: Pays for mobility aids like wheelchairs, crutches, walking frames, or braces.

-

👩⚕️Home Nursing: Covers up to 30 home visits by a licensed nurse if certified as medically necessary after hospital discharge .

2. 💵 Living Plus Rider (Income & Lifestyle Support)

Focus on your recovery without worrying about lost income:

-

🗓️Weekly Income: Provides a weekly allowance for up to 52 weeks if you suffer a temporary disability and are unable to work.

-

🏠Long-term Support: Pays a Yearly Living Benefit for up to 10 years if the accident results in permanent total disability, paralysis, or loss of limbs/sight .

3. 🎓Child Plus Rider (Future-Proofing for Children)

Protects your child’s future even if you are no longer there to provide:

-

📚Education Fund: Provides a yearly education allowance until the child reaches age 23 if the parent passes away or suffers permanent disability.

-

✍️Premium Waiver: All future premiums for the child’s Flex PA Plus policy and riders are waived until age 23 if the payor passes away or is disabled .

-

🚨Kidnap Protection: Reimburses ransom payments up to RM50,000 and offers a reward for information leading to the child's safe recovery .

4. 🏄 Active Lifestyle Rider (For the Adventurous)

A financial safety net for your hobbies and leisure activities:

-

🧗Extreme Sports: Coverage for accidental death while participating in activities like bungee jumping, scuba diving, paragliding, or skiing .

-

🏸Sports Equipment: Reimburses the loss of sports equipment due to theft, snatch theft, or vehicle break-ins .

-

🎫Missed Events: Reimburses non-refundable tickets for concerts, flights, movies, or theme parks if you are hospitalized and cannot attend .

-

🛠️Home Modification: Reimburses costs to modify your home (e.g., ramps or rails) to help you cope with a disability.

5. 👴 PA Max Rider (Senior Protection)

-

🛡️Extended Security: This rider takes effect when you reach age 61, providing additional compensation for injuries, disabilities, or death as you get older.

👥 Who is Eligible?

-

👶 Entry Age: Individuals aged between 14 days to 75 years old.

-

📅 Renewal: Policy is renewable up to age 85.

-

💼 Occupations: Open to Occupation Classes 1, 2, 3, and 4 .(Note: Certain riders like Child Plus are only for Classes 1 & 2) .

-

🌏Foreigners: Eligible if holding a valid work permit and belonging to Occupation Class 1 or 2.

-

⏳Waiting Period: A 14-day waiting period applies for infectious disease and food poisoning claims .

💡Note: This brochure is a brief description. For full details on exclusions (such as pre-existing conditions or illegal acts) and specific terms, please consult the official policy contract .

Medi Plus Rider

Living Plus Rider

Child Plus Rider

Active Lifestyle Rider

PA Max Rider

Anniversary Bonus